Strategic Plan 2016-2018: financial targets achieved

Unipol Gruppo

- 1,847 € mln cumulative net profit on a consolidated normalized basis

(vs. target 1,500 € mln - 1,700 € mln) - 386 € mln cumulative dividends (vs. target ~ 400 € mln )

- Solvency ratio at 163% (vs. target 120% - 160% )

UnipolSai

- 1,866 € mln cumulative net profit on a consolidated normalized basis (vs. target 1,400 € mln - 1,600 € mln)

- 1,173 € mln cumulative dividends (vs. target ~ 1,000 € mln)

- Solvency ratio at 202% (vs. target 150% - 200%)

2016-2018 Strategic Plan: business targets achieved

Innovative and distinctive solutions

- Product catalogue updated with over 50 new Motor, Property and Life Insurance products

- ~ 55.0 € mln in cumulative benefits by using Telematics in Motor business

- ~ 40 € mln in benefits from claims channelling towards Auto Presto&Bene garage network and MyGlass, and expansion of repair and assistance services

Simplified customer and agent experience

- 4 new digital touch points released (App, reserved area, website, agency intranets)

- New mobile sales model available for the entire agency network

- Integrated multichannel project launched: ~ 100,000 calls managed by the contact centre in 2018 to support the agency network

More effective physical distribution

- New ‘UnipolSai 2.0 Agreement’ signed with the entire agency distribution network

- Number of Agencies reduced from 3,140 (FY 2015) to 2,615 (FY 2018) with an increase in the average Non-Life portfolio from ~2.0 € mln to ~2.5 € mln

- Program launched to specialise the agency network by introducing ~ 1,100 professionals specialised in Family Welfare and SME

Excellence of the business operating engine

- ~ 46% of Motor claims settled using Telematics

- Medical networks supporting claim settlement expanded (69 Medical Booking Centres and 99 Medical Booking Services)

- Investment in data and analytics skills (100 new professionals hired)

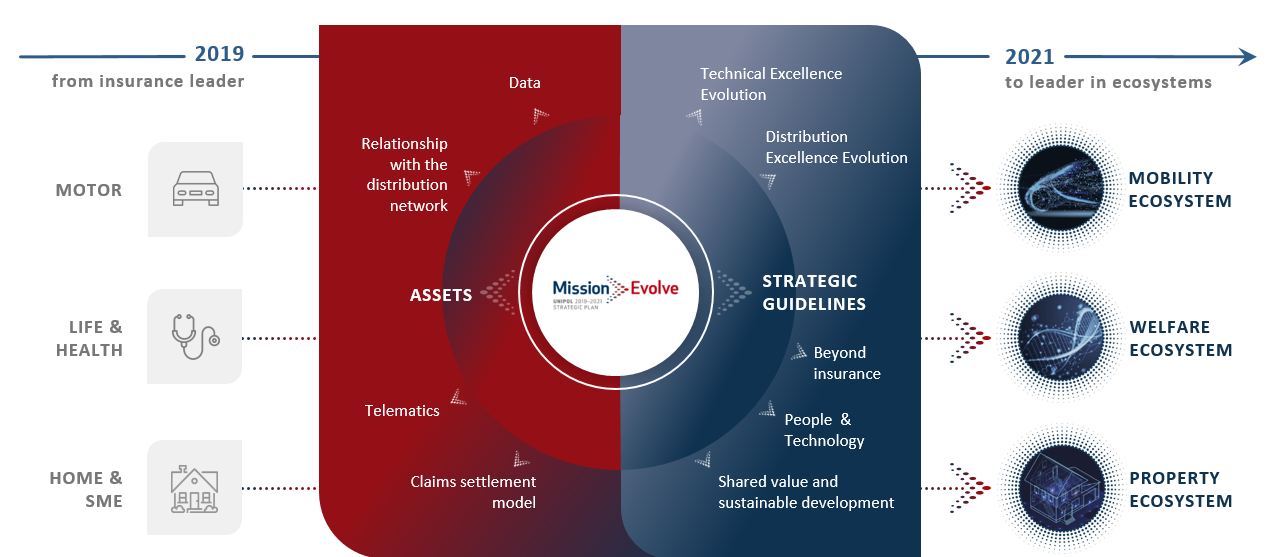

Strategic Plan 2019-2021: Mission Evolve

Strategy Framework

Our Assets

Relationship with the distribution network

| > 8,500 Sales points |

> 30,000 Insurance intermediaries |

|

|

Claims settlement model

| > 86% Motor TPL property damage settlement speed |

> 52% Motor TPL Bodily injury settlement speed |

|

|

Big Data

| > 350 TB Managed data |

|

Telematics

| > 4.0 Mln Black Boxes |

|

Our Strategic guidelines

Technical excellence evolution

Guarantee the profitability of the business through the continuous search for more advanced levels of technical excellence, exploiting the technical and technological leadership in the areas of pricing, risk selection and claims settlement

Distribution excellence evolution

Maximize the value of the UnipolSai brand

Increase the frequency and effectiveness of Customer contacts

Maximise the commercial effectiveness of the leading Italian insurance network, hiring new professionals and providing integrated support through remote channels

Development of the Bancassurance channel and Partnerships

Beyond insurance

Become the reference point for our Customers in the Mobility, Welfare and Property ecosystems, leveraging our skills and benefiting from the integration of our assets

People & tehcnology

Invest in people and technology to accelerate the evolution of our operating model towards simplification and efficiency

Shared value and sustainable development

Create shared value for the Group and its stakeholders, and help to achieve the SDGs (Sustainable Development Goals), reducing underinsurance and developing products and services that increase the security, resilience and sustainability of people, companies, cities and territories